A Skeptics View On The World Around Us.

I‘ve always enjoyed pondering the future, and a considered analysis of the future requires a deep understanding of both past and present. I suspect that while the average person might have concluded that the world all seems a bit weird right now, they might not have any idea why that is so and how it might all play out from here. It’s my belief that we’re deep in the middle of a Fourth Turning, a term phrased by Neil Howe & William Strauss to describe a crisis period that typically occurs every 80–100 years. This essay aims to shed light on some of the key events of this Fourth Turning, led by the GFC & Covid-19, showing what they all might mean and how it might all play out from here.

In Howe & Strauss’ brilliant book, they show how most believe that the world follows linear trends. So how something looks today is how it will look 20 or 50 years from now, just a more advanced version of it. Whereas in reality, the world has followed repeated cycles, each spanning roughly 20 years — an initial high, an awakening, an unravelling and then a crisis that sets the wheels in motion for a post-crisis high where a new cycle begins. Right now, we’re at the unravelling / crisis stage of the cycle.

Whilst I highly recommend that everyone reads The Fourth Turning, the quote from the post-apocalyptic author G. Michael Hopf provides a blunt explanation as to why we tend to follow these cycles:

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.”

Consider what life looked like for someone born at the start of the 20th Century — a world war in young adulthood, followed by a great depression and even bigger world war in your midlife. Strong men and women were born between 1900 to the mid-1930’s and they created good times for those of us who came into the world post-1945. The first 50 odd years of that have been some of the most prosperous & peaceful times in all of human history, then sometime around the turn of the century we began to get complacent and it all began to unravel. The GFC in ’08, I believe, marked the beginning of the crisis period and we certainly have not yet progressed through to the next high.

Given that anyone under the age of 76 has never lived in a pre-1945 world, it occurs to me that most of us are completely unaware of what our ‘world’ actually is. Here’s a quick primer on what the hell is water..

At the conclusion of WWII with the axis powers well and truly defeated and everyone else weary after a bloody three decades, States came together to put together a set of guidelines about how the world should operate moving forward. The Bretton Woods conference in 1944 set out the basis for the global monetary system that we have today — the gold backed USD would become the global reserve currency with fixed exchange rates on the rest of the worlds currencies. In return, the United States Navy would patrol the worlds oceans allowing ‘any nation to go anywhere at any time and exchange goods for hard currency’ creating the worlds first truly global alliance. All that anyone had to do to stay within the alliance was to support the United States in their fight against communism and namely, the Soviet Union.

A few key things happened along the way. In 1971 Nixon temporarily removed the convertibility of the USD to gold, turning the global reserve currency into a true fiat currency backed by nothing but the faith in the issuing government to maintain its value.

Then in ’89 the Berlin Wall fell and two years later the Cold War officially ended with the dissolution of the Soviet Union. With no military disputes (hot or cold) and global oceans fair game for any obedient nation to ship whatever they like anywhere without fear of whether it is going to get there, we’ve had a set of conditions that are unprecedented at any other time in history. The Ottoman or Roman Empires couldn’t exactly ship goods across oceans and pass through chokepoints without having their fleet blown up. Yet for all of our lives as we’ve known them, we take it as a given that goods can get from point a to point b and hence over 90% of the worlds traded good travel over oceans. For all of the young goldfish, this is our water.

https://www.bastiatcapital.com/peter-zeihan-and-the-return-of-american-isolationism/

This set the path for a period of hyper-globalisation. Multi-nationals could create globally integrated supply chains, capital could flow freely across borders, emerging markets could access cheap food and energy and developed markets could import anything they wanted. All made possible by the goodwill of the United States Navy, who continued to provide the stability that was required for all of this to happen despite them no longer needing the alliance support to oppose the now defunct Soviet Empire.

This system has provided enormous benefits for some and enormous challenges for others. In the Western world, the juxtaposition between the winners and losers has been stark. The ‘elites’ – the bankers, the big business executives, the politicians – have revelled in the crony-capitalist Disneyland and become ever more powerful and filthy rich in the process. The average person? Well not only have they lost their jobs to cheaper overseas labour, but when you’re living hand to mouth you’re not investing in assets and therefore the divide between the rich and poor has grown to unprecedented levels.

Perhaps the biggest beneficiary has been China — who for the first time in their history have been able to unify the Han people for an extended period of time and bring their population of a billion plus out of poverty and into tremendous wealth by becoming the worlds largest trading nation by almost a factor of two. The rise of China has also created incredible benefits for the elites — a nation that can provide cheap labour to increase the value of their supply chains, a place with lax human rights and regulatory guidelines that can be used to run experiments that might not fly in the homeland, a rising middle class with a voracious appetite to consume western goods, services and offshore assets like property and stocks. China’s unfavourable geography, lack of natural resources or agricultural land, demographics and political regime means that like most of its 3,000 year history shows, it has no place being a global power. It can, however, thrive in the recent period of global stability but it will all unravel quickly if that stability changes. More on why this dispels many of the current narratives on China later.

So with humans doing what humans do, we grew greedier and greedier and pushed the system to its outer limits and very nearly blew the whole damn thing up in ’08. Most reporting on the GFC fails to delve into the complexity of what really happened — the subprime mortgages were a small part of a bigger story and the bigger part rarely gets discussed. What was really happening with the subprime loans is that they were getting packaged up into investment grade products that could be used as collateral in an interconnected global banking system. Collateral works the same way as a house deposit — its the cash/asset that you put up in order to get a multiple of that collateral as newly printed money in the form of a loan. Collateral was once gold or high grade government bonds like US Treasuries, but in the hyper-financialised world that we’d created over the proceeding decades there was a desire for more and more collateral to create more and more loans. Greed meant that bankers found ways to turn the finance worlds version of dog s**t into safe collateral and when the players of the game realised the collateral was worthless, the whole house of cards collapsed in on itself. And in the hyper-globalised world, that collapse was systemic and spread absolutely everywhere to the extent that no financial crisis has ever done before.

Despite this growing perception that capitalism is bad, capitalism could’ve shown its greatest characteristics in the response to the ’08 meltdown — creative destruction and the removal of moral hazard. Where if markets were let to run their natural course, we would’ve likely seen a mass round of bankruptcies from every entity that had spent too long flying too close to the sun. Goldman Sachs and JP Morgan would’ve likely followed the same fate as Bear Stearns and Lehman Bros. Overleveraged zombie companies like Macy’s and the American Airlines are caput. Would’ve letting markets do their thing caused a repeat of the 1930's? Maybe. I can understand why that potential scenario was avoided (and will continue to be avoided) at all costs, but if it was allowed to play out you could bet damn well that bankers wouldn’t have operated with the same level of moral hazard in the years since & CEO’s like American Airlines Doug Parker wouldn’t have pocketed $200M in earnings despite their company posting negative free cash flow in the same period.

Instead what we saw, with the ‘socialist’ President Barack Obama & his then VP Joe Biden at the helm, was the greatest example of crony capitalism that we’ve ever seen (at least to that point in history). The banks were bailed out by the Central Banks & the show went on, but in the most bifurcated recovery that one could possibly imagine. By bailing out the financial system, the Central Banks were able to kick the can down the road and keep the system that had benefited the elites for so long going, but at the expense of everyone else who has lived through an invisible great depression for the 12 years since. None of the structural issues that caused this crisis were fixed, but in fact they were made worse by setting us down a path where moral hazard in everything has created an everything bubble thats too big to fail and backs policy makers further and further into a corner. In the chart below, we can see the value of the S&P500 over the last century with the depths of the GFC period circled — now in the years since we’ve either entered a period of extreme prosperity, or something really weird is going on.

S&P 500 chart from 1872 — present

When you consider that it might be the latter and that something weird is going on, you should also consider that the same Central Bankers that are supposedly regulating financial markets and ensuring financial stability are working directly with the very companies that they’re bailing out and meant to be regulating. Former Fed Chairs & Vice-Chairs have gone on to enjoy highly compensated roles at the likes of BlackRock, Morgan Stanley, Pimco, Citadel & Deutsche Bank to name a few. Biden’s current Treasury Secretary and former Fed Chair, Janet Yellen, spent her two year hiatus between roles delivering $7M worth of speeches to Goldmans, Barclays, Citadel, UBS & Standard Chartered. She knows where her bread gets buttered and now controls the purse strings of the United States Treasury Department. It’s been an incredibly good decade to be an elite.

Make no mistake, the GFC very nearly ended the world as we know it in ‘08-’10 and the response was mere wallpaper over the cracks. But it was not a well-intentioned wallpaper over the cracks, for anyone paying attention it was a clear sign that something is rotten in the State of Denmark.

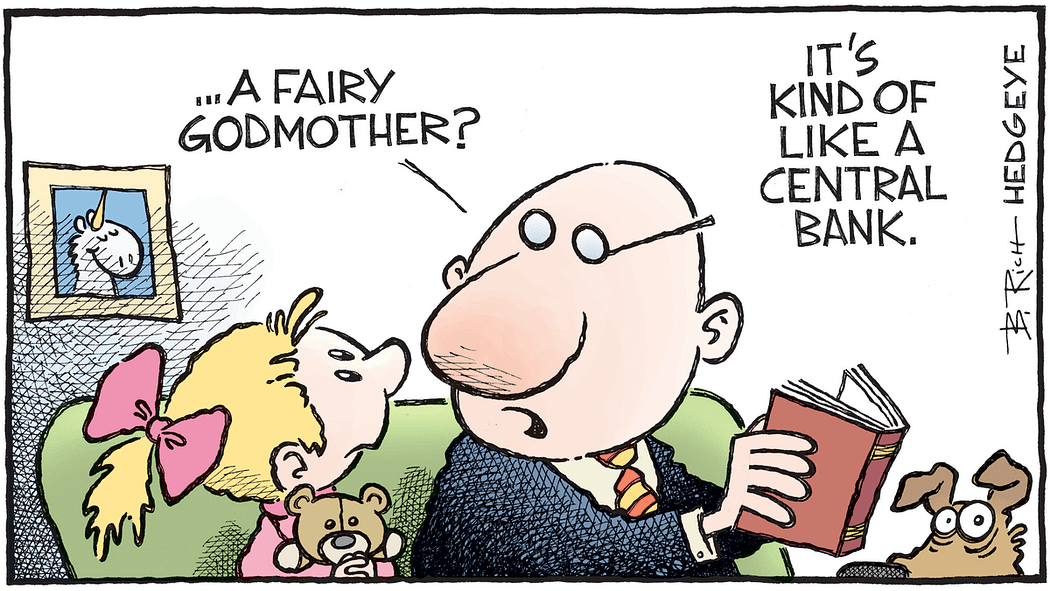

With the temporary launch of quantitative easing (QE) post GFC, the Central Banks were able to take advantage of the crisis and make themselves the most important game in town. By printing fresh bank reserves to buy bonds, the Fed pinned the most important price in global markets several hundred basis points below its long term average. The Fed funds rate is the interest rate thats effectively the baseline for every other price in global markets — treasury yields, corporate bond yields, equity risk premia, mortgage rates and so on.

Chart courtesy of https://twitter.com/RudyHavenstein.

What the Central Bankers, the elites and the rest of the merry men and women did was artificially suppress volatility in financial markets. The problem with suppressing volatility in one place is that it can’t be removed, it can only be shifted. In removing it from financial markets, they shifted it into general discontentment in society.

You might remember the aftermath of the GFC saw this discontentment pop up in a range of anti banker/capitalist/government movements. There was the Tea Party Movement and devastating mid-term election results for the one time great white hope in President Obama in 2010. The Arab Spring protests in 2011 due to the rising costs of living for the Middle Eastern poor and middle classes. Then the Occupy Wall Street movement in 2011 when the angry mob realised they’d been screwed at the expense of the elites. And it’s not surprising that the then very obscure new technology to decentralise money called Bitcoin popped up.

Then something peculiar happened. Occupy Wall Street sort of dissipated and around 2012 a bunch of other topics started to dominate the agenda — climate change, racial inequality, LGBTIQ rights. I think we should do more to protect the environment and we should treat all people with respect, regardless of their colour or sexual orientation — but did we really become a population of environment destroying bigots all of a sudden or were the powers that be trying to influence where we placed our rage? I’ll suggest its option b.

https://www.tabletmag.com/sections/news/articles/media-great-racial-awakening

One only needs to look at the home page of the incredibly influential World Economic Forum to see where their focus lies. Covid-19, Pride Month, Racial Injustice and Climate Change dominate their current home page. Very little on ‘economics’ and certainly nothing on the underlying issues in post-GFC financial markets. Prominent WEF members include ECB President Christine Lagarde, Citadel President Ken Griffin, Former Treasury Secretary Steven Mnuchin, billionaire investor George Soros, JP Morgan CEO Jamie Dimon, Harvard President and Treasury Secretary Larry Summers, as well as the late Jeffrey Epstein confidants in Bill Gates and Prince Andrew.

I do sometimes wonder if the woke crowd stop and think how strange it is that all of a sudden they’re aligned ideologically with this peculiar crowd that they’d be throwing rocks at in any other life (and indeed were throwing rocks at just a few years earlier).

But as Mark Twain noted – it’s easier to fool people than to convince people that they have been fooled.

At Jeffrey Epstein’s Manhattan mansion in 2011, from left: James E. Staley, at the time a senior JPMorgan executive; former Treasury Secretary Lawrence Summers; Mr. Epstein; Bill Gates, Microsoft’s co-founder; and Boris Nikolic, who was the Bill and Melinda Gates Foundation’s science adviser.

Before you consider that to be one big conspiracy theory where the ‘deep state’ are gathering together in a secret room and influencing our decisions, take some time to consider just how easy it is for these trends to happen. The influential elite, sensing that an angry society are beginning to threaten their status quo, only need to seed some ideas and let the media machine take care of the rest. This became even more easy to control with the rising influence of social media platforms, which came into our lives in the late 2000’s and moved into overdrive by the time the woke agenda items started to gain prominence. Not only did social media and other technology allow ideas to spread at a rate like never before, but the shallow dopamine hits they’ve trained a generation to crave has done all sorts of things to the state of our mental health and ability to apply critical thinking.

Financial markets are complicated, so the average person didn’t really know what was going on or why what was happening was bad and in this shallow clickbait world we’ve become trained to live in, they certainly weren’t willing to do the depth of analysis required to understand it. Nevertheless, people just started to feel more hatred, anger and general apathy. The general discontent was a warehouse full of firewood and social media was the gelignite — the elites didn’t need to do much more than throw a match in there to set it all off and before you know it, we’d all forgotten who the real villains were and instead started attacking each other about the incorrect use of pronouns.

We’d turned on each other so much so that the silent majority realised the only way to fight back was at the ballot box. The Brits voted to Brexit in ’16 and have argued with each other in the five years since about how to actually do it. Then the former Apprentice Host read the room like a book and got himself voted into the highest office in the universe later that year, with the Americans having a fair time during his tenure doing little else but despising each other. The architects of the GFC and subsequent bifurcated recovery could hardly have scripted it better if they tried.

Fast forward to the end of the 2010’s and we start to get towards the denouement of this whole post-1945 cycle. Firstly, in 2018 the new Fed Chair Jerome Powell decided to make an attempt at starting to taper rates. But as the wonderful @RudyHavenstein notes in the chart above, a mere 100 basis point increase started to open up the cracks on an incredibly sick and overleveraged global economy — leaving Powell little choice but to reverse course. Like in a video game where you peak around a corner and a bullet whistles past your head, this was the Central Banks chance to get a preview of what might happen should they ever be forced to raise rates (say if an inflation threat started to get out of control…). What Powell saw is the same as what anyone paying attention to financial markets already knew — that the world never recovered post GFC and the underlying problems were as bad as they’ve ever been.

The elites have known that the world as they’ve known it can’t go along forever and its been hanging on by a thread. If you’re in a position of power and that’s the case, you have two options — enjoy it while it lasts and cede control to whatever replaces you, or try to architect the transition. The hubris that comes from being in a position of power suggests you’ll always go with the latter option and if you’re going to architect a transition to a new regime, there’s a tried and tested method for doing so — via a crisis.

Enter Covid-19…

Whether you’re deep down the rabbit hole of conspiracy theories, or you mostly believe what governments are telling you about Covid-19, it’s hard not to admit that many elements of it just don’t quite add up.

Why are countries so happy to completely shut down their economies and create enormous debt burdens in doing so? Why has the virus basically disappeared from the most populated country on earth, China? How did they manage to get a vaccine developed, manufactured and distributed in less than 12 months? Why have deaths not spiralled out of control in places like Sweden or Florida that haven’t pursued lockdowns? This is even before we start asking questions about the latest Anthony Fauci email revelations.

My take is that this was indeed a lab manufactured virus, developed as part of the controversial gain-of-function programs in the US funded Wuhan Institute of Virology. If we accept that as being the case, there’s three broad theories for how it’s escaped the lab:

The Chinese released it deliberately to wreak havoc on the world.

Dr Fauci and his other technocrat mates released it deliberately to wreak havoc on the world.

The virus escaped accidentally.

Remembering back to the point earlier about the Chinese being the the biggest beneficiaries of global stability, option one makes no sense. The overleveraged, largest trading nation in the world does not benefit from instability and a global economic shutdown. And a CCP that rules 1.5 billion people without a popular mandate are only ever one bad move away from losing power — they know this, hence the posturing and censorship.

Option two is a conspiracy theorist favourite. Just like fire chiefs are known for starting bushfires, what does scare me is that this could actually be a plausible scenario. The Bill Gates and World Economic Forum hosted ‘Event 201’ pandemic simulation in October 2019 doesn’t do anything to defer the conspiracy theorists — nevertheless it’s not what I think happened.

That leaves option three, which makes the most sense if you look at every single thing that has happened throughout with this lens. A lab leak of a virus that shuts down the entire world is embarrassing, to say the least, for the culprits. So not just the CCP, but the WHO, Fauci and every other group involved would prefer for the public to think that it was something else. It explains the contradictory comments from authorities throughout.

Again, this doesn’t have to be some big conspiracy that everyone is in on. All that’s required is to seed an initial narrative and let the various characters in the story take care of the rest. It worth remembering that despite the carnage Covid-19 (or rather the response to it) has caused, there’s been several groups that have had the best year of their lives and have no incentive to shift narratives. Politicians, State Governors, Media Outlets, Public Health Officials and Epidemiologists just to name a few.

It doesn’t help that throughout the past 18 months, basically every institution or supposedly trusted source has appeared to be compromised or pushing their own agenda. Our society of people who increasingly hate each other have basically landed in one of two camps — they’re either completely distrusting of institutions and don’t believe anything, or they’re completely submissive to governments and believe everything. As such, I’m not sure we’ll ever really know the truth about Covid-19.

So how does Covid-19 tie back in to the GFC response and how have the elite connected the two?

Equity markets started to get shaky in February 2020 and by March 2020 they were in free fall, ultimately bottoming in mid-March. The Lords of Finance, the five chiefs of the G7 Central Banks who are all trained in the same economic theories and get together regularly to discuss how they keep the music playing, single handedly decided on how this crisis was going to play out. They stepped in and provided a mind blowing amount of liquidity to stabilise financial markets — and the music kept playing all right, as the extra $10T they added to their balance sheets sent markets into the biggest 12 month bull run we’ve ever seen.

My guess is that a combination of fear that the system was finally collapsing and opportunism that they could use Covid-19 as the cover, the elites decided that this was the time to roll all of the systemic issues into one. Going back to the aforementioned point about whether elites can really control the world, let’s look at an example of exactly how this has been done (remembering that the likes of Gates, Fauci, Yellen, Lagarde et al are all very close).

On April 16th the former Governor of the Bank of England and esteemed WEF member, Mark Carney, produced a column in The Economist talking about what we can do in a Post-Covid World and how the pandemic provides us with a chance to create a new world where the “new hierarchy of values will call for a reset on the way we deal with climate change, which, like the pandemic, is a global phenomenon”. A month later, the WEF began talking about the Great Covid-19 Reset with the headline that “COVID-19 offers a chance to reset and reshape the world in a more sustainable way”. The key elements of this are that we need to focus on the planet, people and profit — how altruistic.

As the months followed, the messaging went into overdrive. The IMF Managing Director, Kristalina Georgieva spoke about how the enormous Central Bank supported fiscal stimulus programs were needed but also needed to ensure that a “paramount importance that this growth should lead to a greener, smarter, fairer world in the future”. By June 2020 the technocratic Founder and CEO of the WEF, Klaus Schwab, had even managed to write and publish a book titled COVID-19: The Great Reset and within days had copies delivered to the world leaders of every important nation on earth. It didn’t take them long to build campaigns about the great reset and the opportunity it presents us with to build back better. Celebrities and sports stars caught on to these messages that aligned with their beliefs, so then you have Billie Eilish and Lebron James pushing it to their 150M+ online followers, who connect the messages they hear from their idols with the soundbites being delivered by expert politicians who know exactly how to appeal to the masses.

Interesting that none of this messaging makes any reference to the role that Central Banks and technocrats have played in creating these crises. But here, right before our eyes, we’ve seen an example of how a handful of those same technocrats that have created the issues were able to seed a message that quickly became mainstream. They made a naive population believe that the real issues are somewhere else and that ironically they have the answers to solve them. The beauty in the execution of this campaign is that by wrapping it around altruistic ideas they’ve been able to pigeon hole any critics of the campaign as a raging right wing loonie — I mean how could you not be in favour of helping the environment, inequality and sustainability? You’ll notice that just this week, the good folk over at JP Morgan and Citi decided to resume their political donations but not to any of those ‘crazies’ who contested Biden’s victory. And Facebook joined Twitter in their role as fact checkers to ban the ex-President from their platform. In any other political environment, Facebook and Twitter might find themselves subject to increased anti-trust and taxation on their media monopolies, so it suits their cause to back the status quo too. Set the initial narrative right and the rest will take care of itself.

This brings us to today – the now. We have a world where the global debt to GDP ratio sits at 356% (up from 320% just 12 months ago). The level of fiscal deficits in every developed economy sit at 10–20% of GDP and climbing. The only thing holding this all together is the intervention, both monetary and fiscal, from governments that are heavily influenced by the technocrats who have benefited so greatly from the status quo. But the challenge with intervention (in what are supposed to be free markets) is that it has all sorts of unintended consequences and distortions — like what we’ve seen over the last year with +30% returns on the S&P500, Dogecoin valued at $50B, NFTs selling for $70M, house prices surging 20–30%, the price of lumber up 250% and agricultural commodities like wheat up 30%. All of this is without even mentioning the fact that the 2020’s is the decade that the Baby Boomer generation retire, en masse, and are due pension liabilities where in the US alone that figure is estimated to be $150+ trillion (5x the national debt) and currently completely unfunded. Forget taxes, forget growth — there’s no way this will ever get paid. The path we take from here is dependent on the decisions that get made by those in power, so we must consider what their objectives are.

Broadly speaking, there’s two ways this whole show ends and the debt burden is cleared — a deflationary bust, or an inflationary bust or as Chris Cole says “you can either default on the debt, or default on the currency”. A deflationary bust is the 1930’s, where debts default and because one mans debt is another mans asset, the whole system collapses on itself. An inflationary bust is Weimar Republic 1920’s, where currency becomes worthless and therefore so does the value of the debts that are owed. In the first scenario, you want to own debt (at least you can exchange it for whatever hard assets are available from your debtor) whereas in the second scenario you want to owe debt (because your leveraged hard assets become yours for free).

The first option is that one that is favoured by free market purists — if someone has taken on debt that they can’t afford, the market should punish them. The problem with a deflationary bust is that its slow and drawn out, it feels really bad in the short term and would go against everything that policy makers have done over the last three decades — how could markets crash and insolvencies run riot and Central Banks not step in to save them? The other big risk of a deflationary bust is the risk that policy makers lose control of the populace and they vote in a leader who promises to fix all the problems created by the current government. The 1930’s shows you that playbook.

The second option is an inflationary bust.This is where policy makers either run their currency completely into the ground (eg Weimar 1920’s or Argentina in recent years) in a true hyperinflation scenario, or they manufacture a period of high inflation (10–20%) and peg long term interest rates well below, creating deeply negative real interest rates. This option feels great in the short term — politicians get an open chequebook and the average citizen sees their debts inflated away. The problems — anyone who has lent money or saved has the value of those assets obliterated and if you lose control of the situation, it pretty quickly can become hyperinflation.

My base case is that we don’t have a deflationary bust, although I do believe that there is a distinct possibility of a short and sharp bust that will force a response that makes option two inevitable. My bet is that the elites have enough hubris to believe that they can actually pull off option two in a controlled manner, but they‘ve also created the perfect alibi if they do lose control of it. If it all goes wrong it was the pandemic response and climate change funding, not the systemic issues we’ve built into the system for 30 years. I think the attempt has already commenced with the Covid-19 stimulus (how’s those asset prices going vs the fixed rate debt at 2%?) but that they’re going to lose control of it within 2–3 years from now.

Losing control is going to be one of two things and neither are good.

The first path is that the loss of control is due to market forces- for example, the +$100T sovereign bond market says no thank you and Central Banks lose control of the long end of the curve. In attempt to regain control we go through a period of increased centralisation of power and decision making. Price controls, capital controls and more and more macroprudential policy in order to keep financing conditions favourable so that we can build back better. Added to these financial controls is more government involvement in everything that we do — perhaps like vaccine passports, travel restrictions and lockdowns? Central Bank Digital Currencies (CBDCs) will play a prominent role in this environment, as will the Bretton Woods 2.0 where the technocrats leading this world get together to design a new global monetary regime.

We’ve had an insight into this world over the past 18 months, but it’s gone by largely unchallenged because for many people its aligned with their ideologies. Trump might have been a lunatic, but when he called out the lab leak theory it was dismissed as being a crazy conspiracy theory that did not align with the truth as told by the likes of Fauci, WEF and policed by Facebook, Twitter and the rest of the mainstream media. Today, anything that does not come via these trusted channels is labelled a conspiracy theory. This is not the behaviour of a healthy society — this is the behaviour of Communist China, The Soviet Empire, or Orwell’s Oceania. And when you realise that the groups setting the truth or agenda are not necessarily well intentioned, it’s even scarier.

The second path is one that more closely resembles the world for the several millennia before 1945, where the technocrats don’t just lose control of the bond market, they start to lose control of the people. In a fight between centralisation and decentralisation, the attempt to establish control on a system that presides over seven and a half billion people proves impossible. This is what it looks like if one or two key players fail to tow the line, most likely as a result of their own internal politics and that can quickly set off a domino effect as others start to follow.

The important backdrop to this that isn’t being considered anywhere near enough is the retreat of the USA as the global security guard. As geopolitical strategist Peter Zeihan discusses, the US never updated their strategy post Soviet Empire and the global order has benefited everyone except their own population. Internal politics will always trump international politics, pun intended, and right now America has a whole lot of mess on their home turf to sort out. Yes Joe Biden continues to talk the globalist language, but diplomacy without a Navy patrolling global waters can only go so far. If a right wing uprising takes hold in say, Germany, and they decide to seize some borderlands as opposed to joining this technocrat global order — is Joe Biden going to provide the military support to the EU to counter that? Or if he is, does a Tucker Carlson make a run for President in ’24 on a similar but more refined platform to the one that almost got an orange ex-celebrity eight years in office? And that’s just viewing things through the lens of our post-1945 water, because if there’s no one patrolling the water ways then we’re back to a decentralised world where its every state for themselves and food and energy become the two most important commodities in town. America can cope with this world with their vast natural resources, agricultural land, shale oil and friendly borders — very few others can. China lasts about three weeks. Europe returns to the blood stained continent its been for most of recorded history, with the line from Scandinavia to Moscow to Turkey quickly becoming a war zone. The Persian Gulf follows, as does the East Asian Rim. Suffice to say, this isn’t going to be an easy few years for the technocrats.

ECB President Christine Lagarde recently said that climate change was the biggest challenge facing the Central Banks right now. Well Madame Lagarde, I’m going to call your bluff on that and suggest that the real existential crisis is that we’re one bad step away from either a Third World War or the malaise of a global command economy. Either way, this is the final stanza of our current Fourth Turning and our water is about to change temperature.

(Initially published on June 5th 2021)