The property crash where prices will skyrocket

The Aussie Dream that is our housing market has always been a popular topic and it’s becoming increasingly divisive. Australian real estate is an asset class has a little bit of everything. There’s elements of scarcity that makes it comparable to real assets like gold and a yield that provides a store of wealth with an income, just like what government bonds should be. But concurrently, there’s credit driven speculation that makes it a quintessential asset bubble. This backdrop has created two groups of people — there’s the permabulls who believe that prices only ever go up, or there’s the growing group of alarmist bears predicting prices to crash by 50%+. What if they’re both right, or even that they’ve even both been right for the past decade or more? This is an asset bubble that could pop spectacularly, but we’re more likely to see prices double than we are to see them halve.

The total value of residential real estate in Australia is estimated at over $6 trillion, roughly in line with the annual GDP of Germany. This total market is incredibly nuanced, including everything from community apartment projects in Northern Territory to harbourside mansions in Sydney and everything in between. Price trends on these individual markets will follow a very different trajectory and it doesn’t make sense to make assessments on the market as a whole. This article will focus primarily on premium houses in Melbourne & Sydney, the two markets that have seen the most meteoric price rises over the past decades and therefore where opinions are the most divided.

The 8m+ households who own their own home, albeit with about two thirds of those subject to a mortgage, have often made more money from home equity than they have from working. Boomers who bought prime real estate in the 90’s for the same price as a Millennial might spend on a European holiday are now multimillionaires. The wealthiest ones own several properties, purchased using the BRRRR method of leveraging against equity and aided by favourable tax incentives like negative gearing.

Real Estate, as priced in Australian Dollars (AUD), has risen rapidly in the three decades since the ’91 recession. Factors like immigration have clearly played a role, but undoubtedly the major driver of price appreciation has been credit growth aided by falling interest rates. Even the staunchest of property bulls would not disagree with the fact that prices would not have risen then way they have without mortgage growth.

Interest rates in Australia have followed the global trend of a steady downward increase towards the current zero bound.

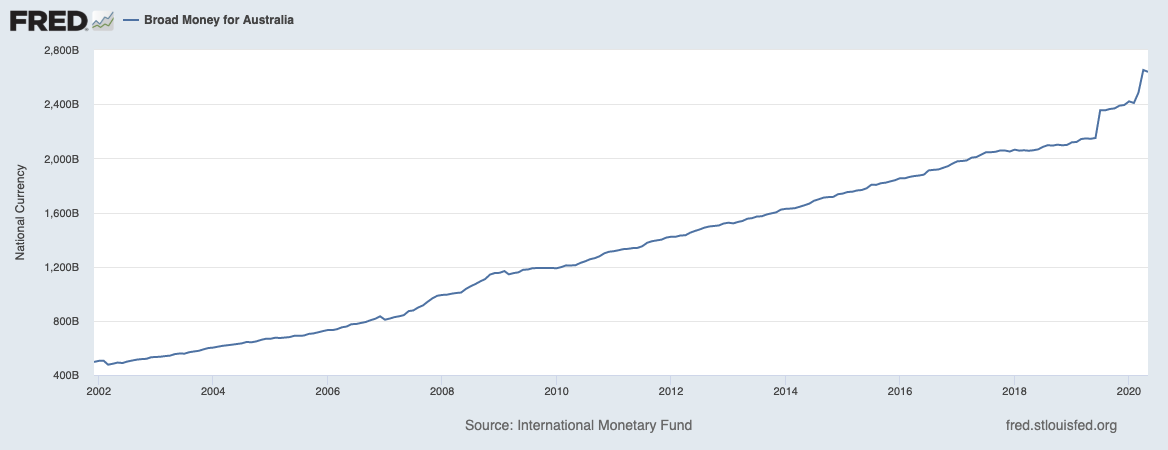

If mortgages had been outlawed and people could only pay cash for real estate, the charts above would clearly show a different picture. This might seem obvious, but there’s an important element of this that very few have taken the time to understand. Mortgages allow new Australian Dollars to be created, so without mortgages there would simply be less dollars in the system.

Imagine an extremely simplified scenario where the starting stock of dollars was 100 and there were 10 identical houses. If transactions are done with existing money, then each dollar retains its value and the price of each house should be $10. If we allow for an additional $100 to be included in this system via mortgages, we now have $200 of currency but the same number of houses, so each house is now worth $20. The property speculators and mainstream media will say that prices have doubled, but what’s actually happened is the value of each dollar has halved.

Professor Richard Werner, perhaps the worlds leading expert on banking, dispels many myths in this video where he explains how money is actually created which is contrary to the popular belief that banks take in deposits from some people and loan that same money out to others. The simple takeaway is that money is created, essentially out of thin air, at commercial banks when they issue loans. That loan is accounted for as an asset on the banks balance sheet and a liability of the borrower, known as a mortgage. When a bank issues a new mortgage, there is asset credit creation of new Australian dollars to purchase property.

If you overlay the charts of Australia’s real estate price appreciation with bank assets and broad money supply, it’s clear that this phenomenon explained by Professor Werner has had a major impact on prices. What happens from here is where things get contentious.

Australian bank assets (loans issued) have grown largely in line with nominal property prices.

Whatever your views may be on Bitcoin, one of the most popular valuation methods put forward is the stock-to-flow ratio shown below. This essentially models the supply of a scarce asset and shows that demand (market price) is determined by the level of flow — the less stock added each year, the more valuable a scarce asset may be. This market dynamic can be applied to more than just bitcoin and precious metals, for example you might consider a limited edition collectable sneaker and the impact on market value should a manufacturer release 10 or 10,000 pairs. Clearly the limited release sneaker would attract a higher price on the open market.

The stock to flow model used to show why bitcoin, silver and gold are so valuable.

A stock to flow model for real estate might consider the current stock of housing and calculate the flow as being new homes that are built each year. So if there’s 1.8 million houses in Melbourne and there’s 100 thousand new homes built in a greenfield development, then the stock (1.8 million) can be divided by the flow (100 thousand) to determine this ratio. You can do this same calculation for global real estate (total existing homes divided by new homes built), or even for dwellings within a suburb where you might see a house demolished and replaced by multiple townhouses or apartments.

At this point, the property bulls are screaming. They’ll correctly make the case that new stock of land, particularly land in prime suburbs, is actually zero. There is no new stock of land in Brighton, Toorak, Bondi or Vaucluse and there never will be. Real estate flow can be new properties that can substitute existing — say for example the future of work is entirely remote, then a house in a run down estate 50km from the Melbourne CBD but easily be substituted by a new house built in a different state. But as long as people believe the aforementioned suburbs to be desirable, then they will always remain valuable under any stock to flow model.

The strongest bull case for real estate is that at its core, it is undoubtedly a valuable asset. Australia is one of the worlds most desirable places to live — we have a western democratic political system, good climate, friendly people, low density and well developed amenities. Unless you can make a case for a mass exodus of people leaving the country, there will always be demand for houses in the prime locations around our capital cities. I can’t imagine a scenario where a portion of the worlds almost 8 billion inhabitants wouldn’t want to live in a 4 bedroom house with beach proximity in Albert Park. Another important factor for Australians is that given our location, we’re not particularly transient. A Melbournian is less likely to move cities than say someone in Berlin moving to Paris, or a San Franciscan moving to Los Angeles.

Melbourne is without doubt one of the most desirable cities in the world to live in.

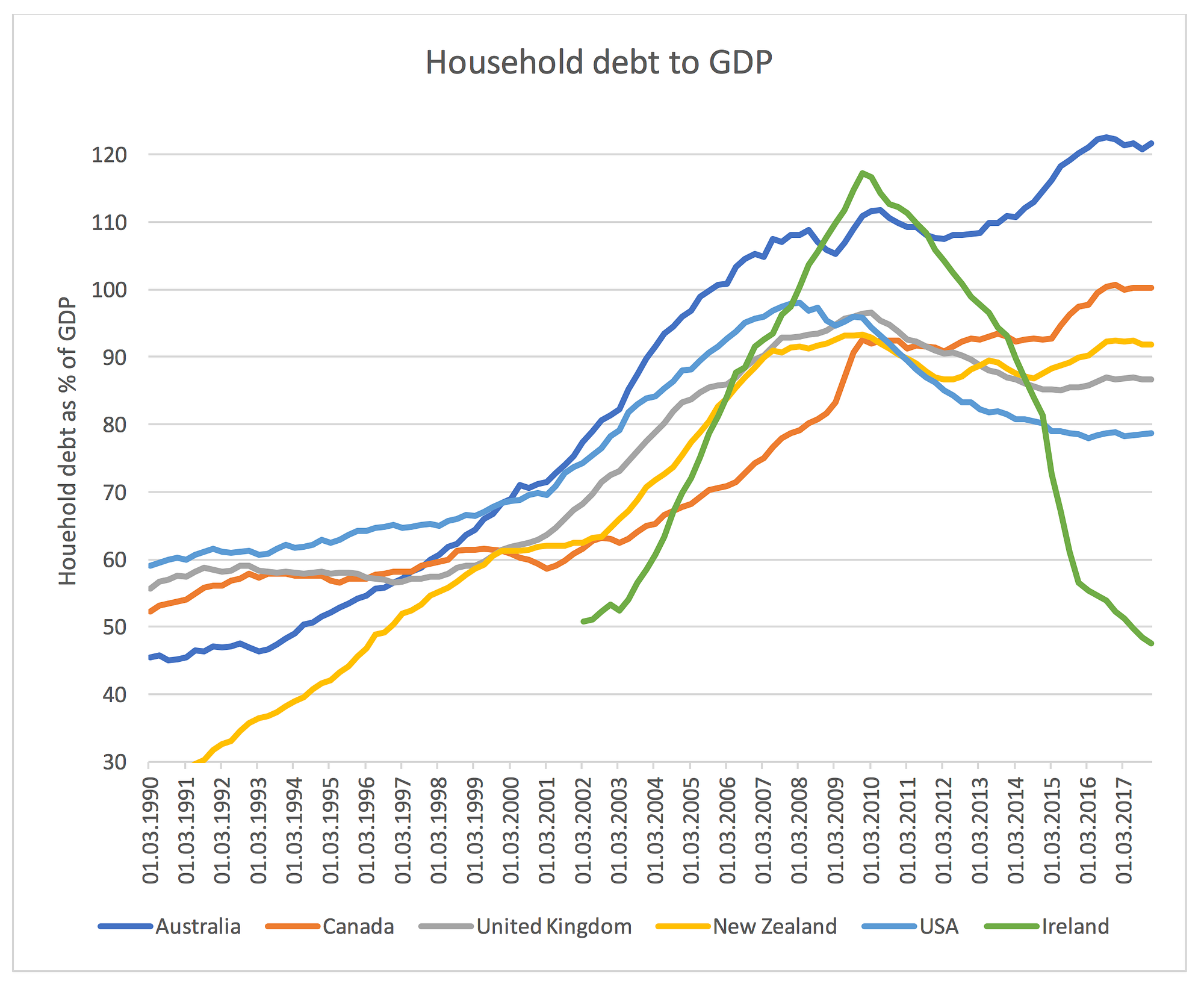

As Warren Buffett famously says, “price is what you pay; value is what you get”, meaning that just because something is a good asset doesn’t mean that it is a good investment. Assets may be high quality, but still heavily overpriced and capable of a collapse. Australian real estate bears will point to our household debt levels to show that we’re a nation of people, fuelled by credit, who are paying too much for property.

https://rogermontgomery.com/australia-leads-the-way-on-household-debt/

The bear case for Aussie real estate is pretty simple and you don’t have to look too far to find a multitude of articles explaining why prices are set the collapse. The focus of this article is not to dispute these factors, which in most cases are very hard to argue against. We’ve had a 30 year run up in debt creating an asset bubble that now has to contend with a calamitous economic shock from Covid-19, stagnant wages and higher unemployment, falling immigration and rising tensions with our Chinese golden goose that are only set to get worse.

It’s clear that over the next few years, the Australian real estate market is going to be faced with challenges we’ve never seen before. This set of scenarios is very different to any other time in history, primarily because of the global backdrop of a monetary regimes which look to be reaching their tipping points.

So how exactly will this play out? My starting contention is that we’re measuring the whole thing the wrong way. Everyone always talks about house prices in terms of Australian dollars, but given that we’ve been creating new AUDs out of thin air to purchase real estate, its questionable logic to get so caught up in the price against those dollars. The hypothetical scenario discussed earlier with 10 houses has already shown what happens when the supply of money increase. We see the exact same phenomenon with median house prices in Melbourne and Sydney, as long as we calculate them in nominal terms. That is that the numerator is AUDs and the denominator is Australian houses — AUDs divided by the median house equals 793,548 in Melbourne and 1,002,107 in Sydney.

Melbourne houses, as priced in AUDs.

Sydney houses, as priced in AUDs.

But what if we change the numerator? In order to choose an appropriate numerator, we need to find an asset whose price cannot be influenced by money printing. In a world of increasingly extreme fiat monetary policies, such assets are hard to find.

Up until 1971, gold was the official measure of currency. That changed with the removal of the gold standard and what that’s done to prices in the 50 years since is summed up perfectly in the charts on this website. The role of gold hasn’t changed since 1971, but the role of money has. The purest reserve asset or currency that exists is gold, for reasons I’ve outlined in this article, so we can get a more accurate measure of Australian real estate by including gold as the numerator.

How many ounces of gold do you need to buy a median house in Melbourne?

How many ounces of gold do you need to buy a median house in Sydney?

It’s incredible what happens to prices when you remove the allure of fiat money as the numerator. If the charts above were what was reported in the media, the headlines would be much different. The bulls would be saying that after 20 years of price declines, we’re about to see the bottom and now is the time to buy. The bears would point to a classic ‘head and shoulders’ technical chart pattern and show that prices still have much further to go.

Head and shoulders chart patterns, which look eerily similar to median house prices in Australia.

There was once a time where Venezuelans or Argentinians primary concern was valuations in their home currencies, but that sentiment can quickly change when the currency becomes worthless. However for the moment, most Australians live their lives in AUD terms and are more interested in what’s going to happen with house prices in their local currency.

With a 30 year price bubble now hit with its first recession, the rubber is about to meet the road with house prices. Something is going to give, the question is whether it’s the numerator or the denominator. If properties are about to collapse against the AUD, then the doomsayer prophecy will come true and median prices in Melbourne and Sydney will fall below A$500,000. My opinion: the chances of this happening are close to 0%, instead the pressure valve will be in the currency.

We’ve come too far for this to be unwound. Something has to give, thats clear. But whether it’s the nominal house prices or the currency ultimately comes down to policy decisions taken by government. The government has been playing poker with their cards face up on the table and using poker parlance, if you haven’t worked out the hands they’re playing then you’re the patsy.

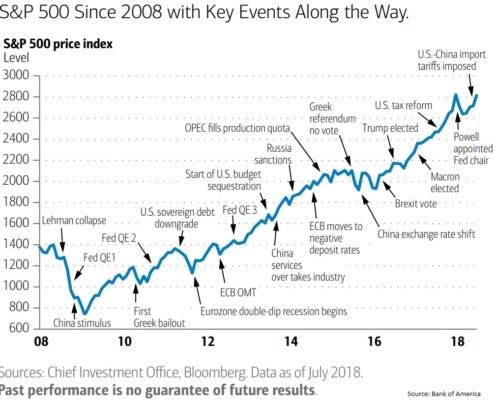

Sure there’s been policies aimed at taking some heat out of the market, but no sitting government is going to be the one that pops the asset bubble — its political suicide. This is the same playbook for every government on earth who controls their own currency and it’s been hyper-charged since the GFC. The S&P 500 is just one such example and you can look at the Central Bank response in 2018 when they tried to hike rates to take some heat out of the bubble.

You’ll notice from the chart earlier that the most indebted nations relative to GDP are all countries who control their own currency. Why is this the case? Because debt and currency printing works like wallpaper over the cracks and can kick the can further down the road so that it’s a future governments problem. You can see house prices in Spain as an example of what happens when a government can’t use their Central Bank to employ monetary policies that bail out the local market. Clearly, the Spanish government didn’t get the all clear from the French Chaired ECB to issue local banks a line of credit similar to what we’ve seen in Australia this year.

Spanish housing prices since 2000.

The Australian Federal Government have shown us their hand. There’s no way they’re letting this property bubble burst, so there should be no surprises at the policy announced last week that loosens restrictions on bank lending. The bears waiting for the crash were up in arms about this announcement, How could they keep propping up this bubble?, but that’s because they’re not paying enough attention to the game that’s being played.

Is it the right policy move? Maybe, maybe not, but I’m not here to make policy recommendations but rather make observations on what’s happening. Of course I can understand why they’re making these decisions though, because a sustained collapse in nominal terms can only be a result of forced selling. The only ones that can really cause forced selling are the banks and the government, who not surprisingly are also the ones who have the most to lose in this scenario. So how could anyone in their right mind think that a government with a four year term is going to implement a set of policy moves that causes their own demise? Changing course now makes little sense and unless I see clear evidence otherwise, I am going to assume that the government will do all that it can to keep the property market propped up. The pressure valve is not going to be nominal house prices, but instead it will be our currency.

Currencies collapse when governments push the boat out too far with unproductive debt that props up the short term interests of its people. There’s been a rapid increase in these instances since 1971, as shown in the chart below.

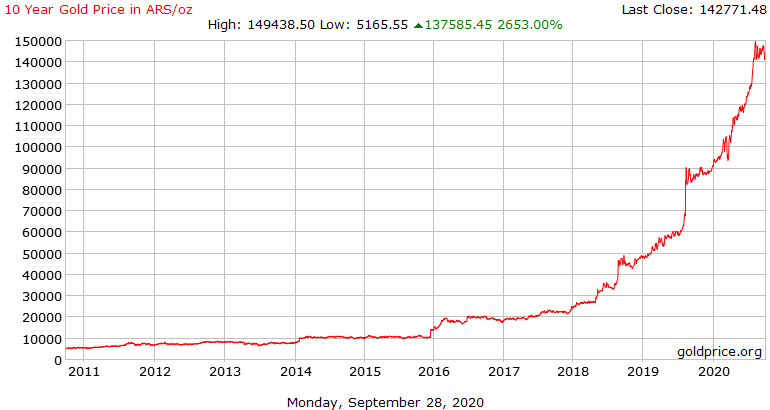

Currency crashes aren’t restricted to 3rd world countries. Argentina and Venezuela are popular examples, but countries like South Africa and Turkey are in the midst of seeing this play out right now. A currency collapse evokes the image of a person taking a wheelbarrow of cash to buy a loaf of bread, but a chart of the currency vs gold as you see with the Argentinian Peso is just as stark.

Any Australian that thinks our currency is immune to a collapse needs to get out of their bubble and get a better sense of reality. All currencies are collapsing vs gold, the question really is at what relative speed to each other.

This is why the bears that are calling for 50% price drops are missing the point. If you’re calling for nominal price drops, then in essence your position is short property and long AUD. But I’m yet to hear a real estate doomsayer whose thesis makes any sort of bull case for the AUD. Of course macro investors might want to position for a bigger payoff and be long gold or other currencies and short property, but the average Australian doesn’t position themselves like this. The question for the average Aussie is one of relativity — do you want to be long Australian real estate, or long Australian government bonds and cash?

This is the question now and even more so the question when a hyperinflation scenario plays out. If you read about Argentina you’ll find articles about the property market collapse, but it’s not prices that have collapsed but rather the volume of sales. With mortgage rates at 50% and a currency that depreciates every day, no one is selling their homes as real estate is the safest form of savings.

Property prices & mortgage rates in Argentina over the past decade of hyperinflation.

My prediction on what the next decade looks like? I think the Aussie Dollar breaks, maybe in the next 12 months or maybe we push it out another few years. If you’re sitting on the sidelines with cash savings waiting for the crash, stop holding your breath. That is unless you see a marked, but unexpected, change in government policies. I think property prices will remain choppy in the short-medium term — there’s not going to be enough demand to drive prices higher, but that will be offset by a continuation of policies that ease any selling pressures and stops prices falling. When the currency breaks is when we’ll see the real action in nominal prices, but it will be a doubling rather than a halving. There will likely be far better assets to be invested in offshore, but locally in this scenario I’ll want to be short AUD (eg you own fixed rate mortgage debt) and long real estate. The Argentinians or Zimbabweans that fixed their mortgages at low rates quickly paid off their mortgages once rates hit upwards of 50%. The same thing happened with German Industrialists in the 1920’s who borrowed subsequently worthless marks to buy fixed assets.

These wont be fun times. The middle class are wiped out, savings are decimated, the price of essential goods and services skyrockets. We’ll get through it, just as all the other States have over the past few millennia who got themselves into the exact same position. But when you keep kicking the can down the road with more debt, it eventually catches up with you.

Children playing with paper planes made of worthless currency in the Weimar Republic during the 1920’s hyperinflation.

(Originally published on September 29 2020)